Agribusiness Salary Increases Show Regional Disparities in 2024

Agribusiness Salary Increases Show Regional Disparities in 2024

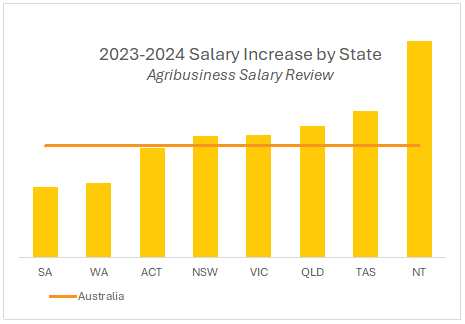

Data from the Agribusiness Salary Review, Rimfire’s remuneration benchmarking tool, reveals a mixed picture of salary increases across Australia’s agribusiness sector in 2024. While some regions have seen above-average pay raises, others have lagged behind, highlighting regional disparities in wage growth within the industry.

The Agribusiness Salary Review, which provides agribusiness employers with live market remuneration data, shows pay rises in South Australia and Western Australia have fallen significantly below the national average for the year ending 30 June 2024. Meanwhile, Queensland and Tasmania have seen more generous wage increases, outpacing other states.

Regional Disparities in Wage Growth

Analysis of Rimfire’s Salary Review points to a varied landscape of wage growth across the country, reflecting the differences in local economic conditions, demand for skilled workers, and industry-specific factors.

In South Australia and Western Australia, salary increases have been notably subdued, with the potential to impact on workforce retention and future recruitment. These regions, both vital to Australia’s agribusiness economy, may face challenges in attracting talent if wage growth does not keep pace with industry trends in other parts of the country.

In contrast, Queensland and Tasmania have provided more competitive salary increases, which could help to position them as more attractive regions for agribusiness professionals. These pay rises are likely driven by strong demand for labour, particularly in industries like cattle farming, horticulture, and crop production, which are key drivers of economic activity in these regions.

National Trends and Local Factors

The national average for salary increases in agribusiness has been influenced by a variety of factors, including ongoing labour shortages, the rising cost of living, and increasing competition for skilled workers. These pressures have led many businesses to re-evaluate their remuneration strategies in order to remain competitive in a tight job market.

However, local economic conditions play a major role in shaping regional wage trends. For instance, local weather conditions, fluctuations in commodity prices, the performance of specific agricultural sectors, and regional investments in infrastructure can all contribute to differing wage outcomes across states and territories.

The Importance of Benchmarking Tools in Decision-Making

The Agribusiness Salary Review continues to be a valuable resource for employers in the sector, providing real-time data on salary trends that helps guide remuneration decisions.

As agribusinesses face evolving challenges such as workforce shortages, regulatory changes, and technological advancements, access to accurate and up-to-date salary data is critical to ensure attraction and retention of key talent.

Businesses operating in regions with below-average salary increases may need to explore alternative strategies to remain competitive, such as offering more attractive benefits, investing in workforce development, or providing flexible working conditions.

Looking Ahead

The findings of the Agribusiness Salary Review underline the importance of regularly benchmarking salaries to market conditions, allowing businesses to stay competitive and position themselves for future growth.