Ag Job Market Shows Resilience in 2024, Despite Slower Growth

Ag Job Market Shows Resilience in 2024, Despite Slower Growth

The Australian agricultural employment market has shown signs of resilience in 2024, despite a slowdown in permanent job vacancies compared to the high demand seen over the past few years.

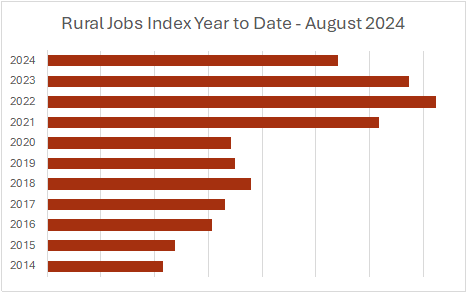

According to August 2024 data from the Rural Jobs Index, while advertised vacancies have eased from pandemic-era highs, they remain significantly higher than pre-pandemic levels.

Year-to-date figures from the Rural Jobs Index reveal that average job advertisements in the 8 months from January to August in 2024 are 46% higher than the decade’s average up to 2020. This indicates that while the sector is no longer seeing the frantic levels of hiring experienced from 2021 - 2023, the need for skilled workers remains elevated, reflecting continued demand within the agriculture industry.

Pandemic Boost Wanes, But Demand Stays Strong

While 2024 has seen job advertisements dip below the peaks of recent years, when demand for agricultural workers surged due to a combination of labour shortages, pandemic disruptions, and global supply chain pressures, the market has not dropped to pre-COVID levels. Results reveal the 2024 year-to-date total is still well above pre-pandemic numbers.

State-by-State Job Market Overview

Western Australia and Queensland have been the standout regions in 2024, recording higher-than-average job advertisement numbers, signalling robust hiring activity in those states. These regions have seen strong agricultural production, driven by both large-scale farming operations and high demand for labour in key commodity areas such as grain, cattle, and horticulture.

However, not all states have followed the same trend. Victoria and Tasmania recorded lower-than-average job advertisement numbers for the year so far, suggesting that demand for skilled workers in these regions may have softened, potentially due to shifting commodity prices or more stable employment levels after previous years of expansion.

Historical Job Ad Trends

The data paints a clear picture of how dramatically the agricultural labour market has shifted since the pandemic. In 2021, job ads skyrocketed, and this surge continued in

2022. While the previous 18 months has seen saw a slight cooling, the figures for 2024 are still notably strong when compared to pre-pandemic levels.

Looking Ahead

While hiring demand in agriculture may be stabilising, the need for a skilled workforce is expected to remain steady, especially as the sector adapts to new challenges such as sustainability pressures, technological advances, and changing market demands.

Despite a reduction in the frenzied pace of hiring seen in recent years, the overall outlook for the agricultural job market in 2024 remains positive. With job ads still significantly higher than a decade ago, and favourable growing conditions forecast for the coming year, the sector looks to remain a key employment driver for many parts of the country.

The data highlights a resilient sector, with hiring demand far outpacing historical averages, even if the boom witnessed over the past two years has somewhat cooled.